As we approach the two-year mark since the FCA’s Consumer Duty came into force in the UK, now is a good time to reflect on what it really means in practice. The Consumer Duty regulatory framework marks a shift in how firms are expected to deliver and support financial services, with a much stronger focus on fair outcomes — including for vulnerable customers.

Financial services play a vital role in people’s daily lives, and digital payments are a prime example of this. As James Eldridge, Manager of the FCA’s Payment Sector Team, puts it: “Payments are an invisible engine of everyday life, powering everything from morning coffee to monthly bills.” By 2033, the UK is expected to see around 58 billion payments per year — averaging nearly three per adult per day — underlining the scale and significance of this responsibility

What is Consumer Duty?

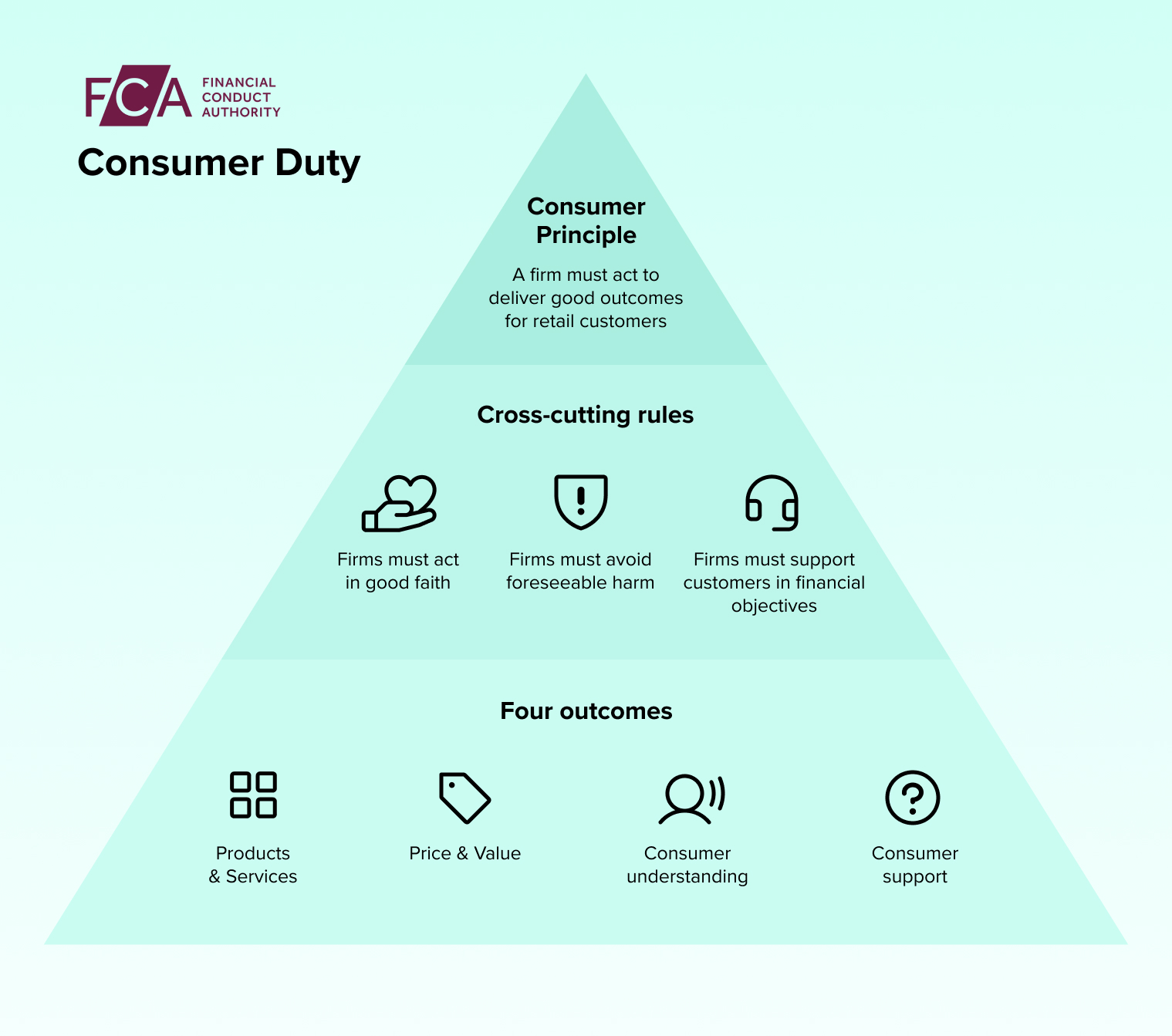

Consumer Duty introduces a new Consumer Principle, requiring firms to “act to deliver good outcomes for retail customers.” It’s underpinned by a comprehensive set of outcomes-focused rules that cover product design, pricing, communications, customer support, and governance.

It requires firms to:

- Act in good faith toward retail customers

- Avoid causing foreseeable harm

- Enable and support customers to pursue their financial objectives

At the heart of the Duty are four key outcomes FCA-regulated firms must deliver:

- Products and services designed to meet customer needs

- Price and value that is fair and transparent

- Consumer understanding through clear communications

- Consumer support that is accessible and responsive

Boards have full responsibility for ensuring the Consumer Duty is embedded within their organisation’s strategy and culture, maintaining effective oversight and constructively challenging decisions to ensure good consumer outcomes.

Firms are encouraged to take a risk-based approach, focusing on complex or higher-risk products that present greater potential harm to consumers, while dedicating resources to ongoing monitoring and evidence gathering of consumer outcomes.

Looking beyond initial compliance, the Duty offers firms an opportunity to drive transformative change by using technology to increase automation, improve customer experience, and ultimately generate long-term value.

Case Studies: Consumer Duty in Practice

Good Practice: Insurance Quote Journey

Some major insurers have redesigned their digital quote and purchase journeys with the Consumer Duty in mind— especially around accessibility, comprehension, and support for vulnerable customers.

By focusing on UX and inclusivity, these firms have:

- Replaced jargon-heavy language with plain English explanations

- Optimised interfaces for screen readers and keyboard navigation (meeting WCAG AA or better)

- Used progressive disclosure to break down complex information step-by-step

- Introduced visible “Need help?” options at key decision points

- Tested journeys with people with low digital confidence, cognitive impairments, and other accessibility needs

Support channels were also reviewed to avoid trapping users in a digital-only loop. Options such as live chats with trained agents, callback requests, and assisted quote completion were added for customers needing extra help.

These improvements reduce friction, improve conversions, and align with the Duty’s requirement to support understanding and access for all customers, not just the most confident ones.

Poor Practice: International Payments

The FCA has flagged pricing transparency in international payments from leading providers in the remittance space as an ongoing issue. With nearly 48 billion payments made in the UK last year — customers frequently send money overseas.

However, FCA research found significant inconsistency in how firms disclose fees and exchange rates. Often, this information is hidden in fine print or presented unclearly, leaving customers uncertain about:

- What they are paying

- Why the charges apply

- How these fees compare to other providers

Lack of clarity prevents customers from making fully informed choices, breaching the Consumer Duty’s requirements for fair pricing and consumer understanding. The FCA has published guidance outlining good and poor practice in this area.

Spotlight on Vulnerable Customers

The FCA’s March 2025 review on the treatment of customers in vulnerable circumstances found continued shortfalls. Many firms are still failing to identify or support customers who may be struggling financially, facing illness or bereavement, lacking digital confidence, or living with accessibility needs.

Common problems include:

- Poor comprehension

- Inaccessible design

- Limited support options

The FCA wants firms to ask:

- Is it clear what the service costs?

- Can people easily resolve problems?

- Are journeys accessible and inclusive by design?

The FCA stresses that anyone can become vulnerable — and vulnerability isn’t always visible. Firms can’t wait for customers to self-identify. Inclusive systems and journeys must be designed from the outset.

How We Can Help

Firms embracing these changes don’t just comply with regulation — they build stronger customer relationships and create long-term business value. Getting this right isn’t just a regulatory requirement. It’s a societal obligation and an economic necessity.

At Indulge, we combine UX, accessibility, content strategy, and ethical AI integration to help firms meet and exceed Consumer Duty expectations. Whether you’re launching new products or refining customer journeys, we help turn compliance into a genuine strategic advantage.

We can help you:

- Conduct UX audits across onboarding, product selection and support

- Run accessibility audits and inclusive usability testing to meet WCAG AA

- Map vulnerable customer journeys and gather real feedback

- Create content strategies that empower consumers with clarity and confidence

- Build ethical AI tools to enhance experiences and spot risks earlier

Let’s turn compliance into a competitive edge and design experiences that serve all your customers better.