In today’s competitive digital finance landscape, delivering an exceptional user experience (UX) is crucial for maintaining customer satisfaction and loyalty.

The FCA Financial Lives Survey reveals a notable shift in consumer behaviour, showing that 47% of consumers used a digital wallet for payments in 2022 - up 17% from five years earlier. This trend highlights the necessity for financial institutions to adapt their services to meet evolving banking and payment needs.

Based on recent UX audits of two banking apps, we have identified several key areas that can significantly enhance the overall user experience.

Streamlined login process

The login process should be quick, intuitive, and secure. For returning users, reducing friction while maintaining robust security protocols is key to ensuring a seamless login experience. Prominently displaying security assurances, such as two-factor authentication or encryption notices, fosters trust and confidence.

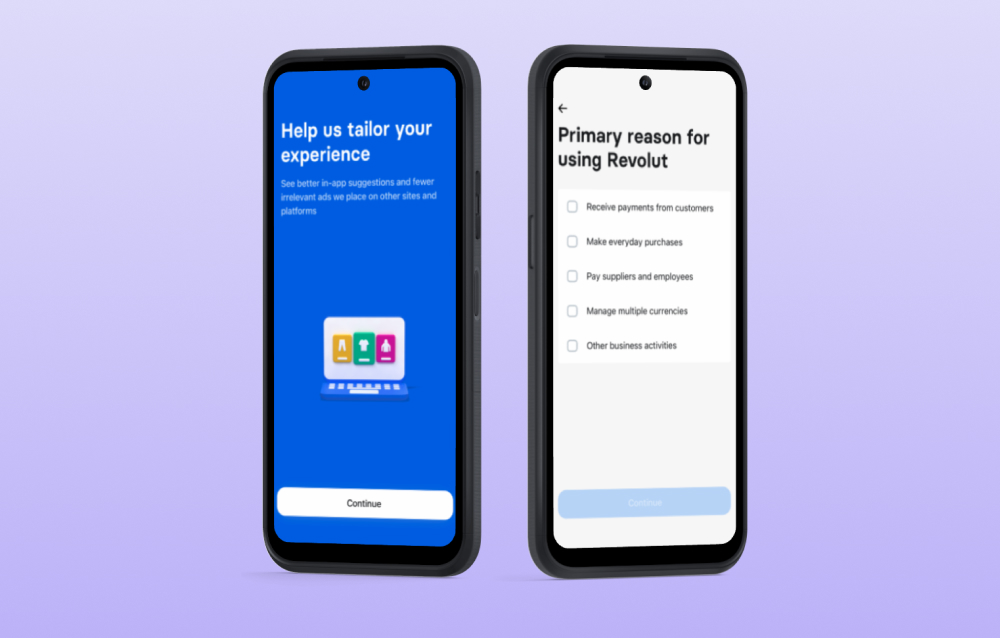

Effective onboarding for new users

Onboarding is critical for first-time users, offering a step-by-step introduction to the app’s core features and functionalities. Guiding new users through this process not only educates them about the app’s full capabilities but also encourages deeper engagement.

According to research done by Invesp, effective onboarding can improve customer retention rates by 50%. The French FinTech service Shine has achieved an impressive 80% onboarding conversion rate through gamification strategies, which include progress indicators and celebratory elements during the onboarding process.

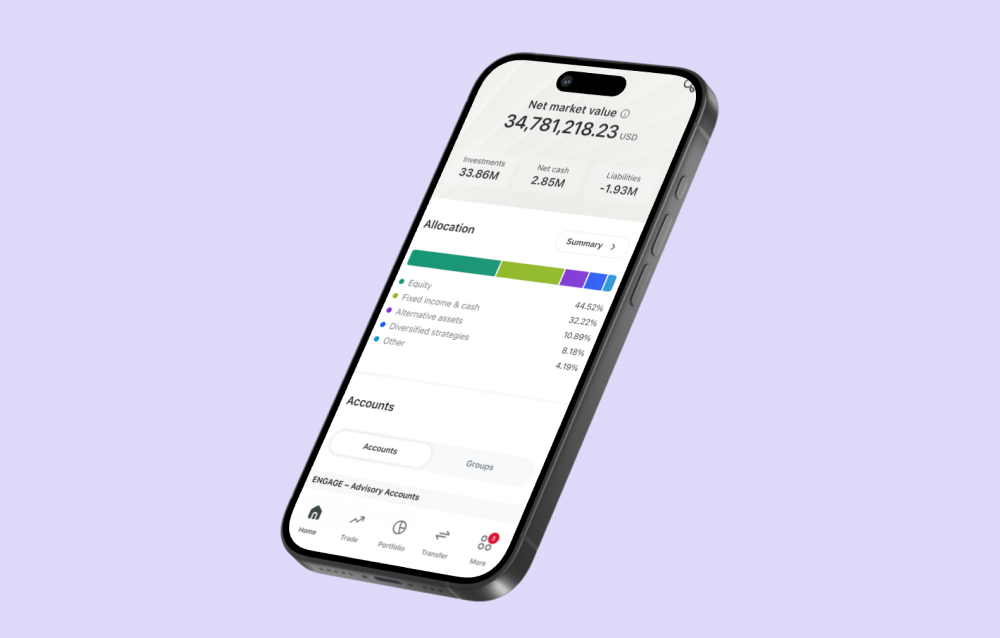

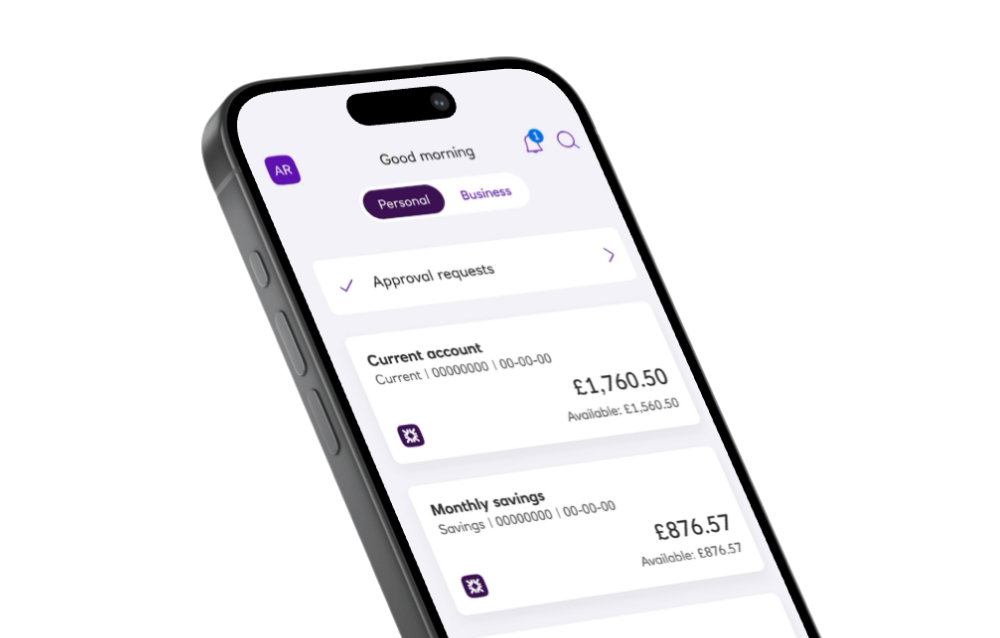

Personalised financial overview

The dashboard landing screen should provide users with a clear, personalised overview of their financial situation. Ensuring an effective information hierarchy helps users quickly access account balances, investment performance and other essential details. Personalisation, such as greeting users by name, adds a human touch that enhances the experience.

Consistent navigation

Clear, consistent navigation ensures users can move effortlessly through the app. A persistent "home" icon or a well-structured menu allows users to easily navigate between different sections. Maintaining consistent navigation across all screens reduces confusion and enhances the user’s overall journey.

Thoughtful in-app notifications

Notifications play a critical role in keeping users informed about important updates, such as transaction alerts, payment reminders, or security issues. In-app notifications must be timely and relevant to avoid overwhelming users while ensuring that vital information is not missed. Clear, actionable notifications keep users engaged and in control.

Simplified payment workflow

Payments are a core function of internet banking and a streamlined payment process can greatly improve the user experience. Breaking the process into clear steps, ensuring UI consistency, and reducing cognitive load help users complete transactions with ease and confidence.

Efficient beneficiary management

Managing beneficiaries should be an independent, simplified process. A dedicated beneficiary management workflow allows users to easily add, remove, or edit beneficiaries without having to navigate through payment workflows. This clarity reduces errors and increases efficiency.

Impactful UI design

Your app's styling must resonate with your target audience while also remaining highly usable. The 10 NN/g heuristics - such as visibility of system status, consistency and standards and aesthetic design - serve as guiding principles to create an effective user interface. Aligning visual language with the preferences of your users and design theory can enhance engagement, satisfaction and overall usability.

Inclusive user experience

Ensuring your app meets WCAG 2.2 AA standards is vital for creating an inclusive experience for all users, including those with disabilities. Prioritising accessibility broadens your app’s usability and helps create a fair experience for all users.

Focus areas include:

- Strong colour contrast for readability

- Screen reader compatibility

- Clear, descriptive form labels

- Large, easy-to-tap buttons

- Reduced motion for those sensitive to animations

Conclusion

A successful internet banking app combines functionality with ease of use, security and accessibility. By optimising the login and onboarding processes, improving navigation and notifications, streamlining payments and adhering to design principles, you can significantly enhance the user experience.

Taking a strategic user-centric approach not only aligns with the evolving needs of consumers in the digital landscape but also supports the principles of Consumer Duty, ensuring that customers receive the best outcomes from your services. Regular UX audits will help maintain competitiveness and responsiveness to customer expectations.