43% of finance-related searches answered by Google’s AI Overviews tool are inaccurate, according to a new study conducted by US finance education site, The College Investor.

AI Overview is the name given to a new Google Search tool. It was first introduced by Google earlier this year in the US and has since reached the UK and other markets.

It involves the insertion of a ChatGPT-like chat interface at the top of the Google Search results page for select search terms.

Here’s an example:

It works well in some cases. For example, if you’re looking for a pancake recipe that doesn’t require you to wade through the writer’s story first, chances are it’ll give you a recipe that won’t kill you.

AI Overviews and Finance

In an article earlier this month, I shared some stats, one of which is that 27% of finance-related searches carried out on Google in the US contain an AI Overview.

The number of searches containing an AI Overview is growing at pace. In June it was 13% (in the US), now it’s 28%.

I think we’re about the witness a bit of a mess in online search.

AI Overviews are essentially unvetted. They are created using a generative AI model that is trained on information from the internet.

In cases such as pancake recipes, as long as it doesn’t recommend adding 150g of Arsenic to the mixing bowl, the odd mistake won’t do any harm.

However, if it starts answering questions about your pension or your banking choices, I’d much rather it was vetted by someone who is trained and verified as a professional.

Can AI Overviews be trusted?

No, basically.

When it comes to financial services, I don’t think the market has room for anything but perfection.

Like the infamous ‘finfluencers’ who are now being questioned by the FCA, the industry simply can’t sustain a search engine potentially sharing misleading or incorrect information.

Google has 90% market share. My colleague, Mayna has just written about Google’s monopolistic tendencies. It’s no small thing if Google shares poor-quality information.

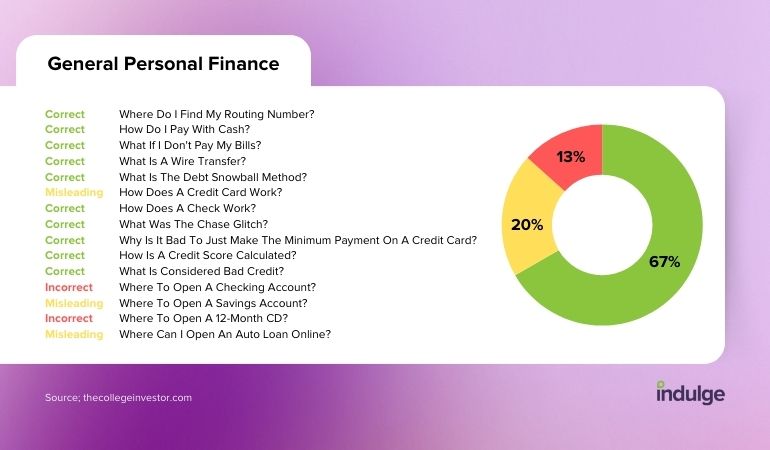

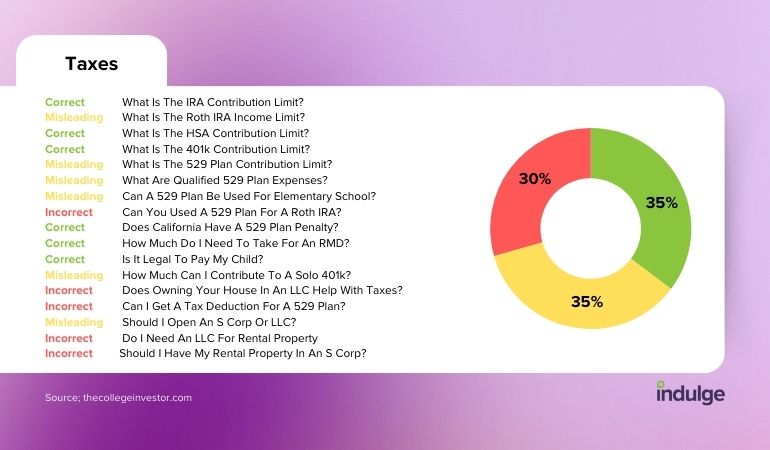

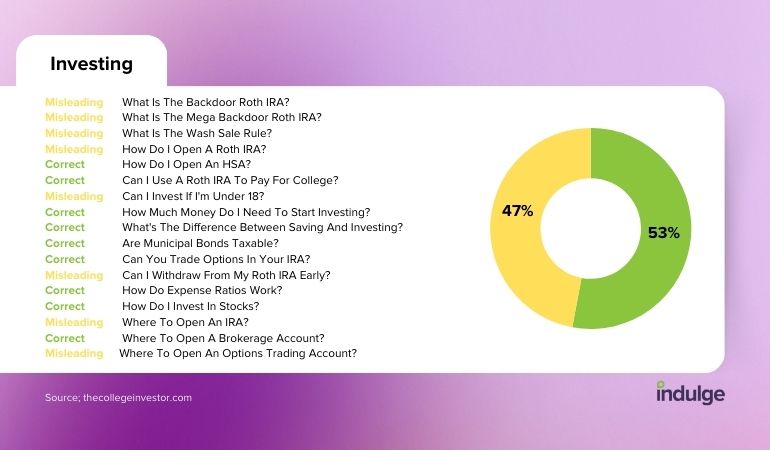

The study in question, conducted by The College Investor involved carrying out 100 searches for finance-related queries, and then analysing how trustworthy the AI Overview answer is.

Overall, 43% were at least inaccurate.

On the topic of general personal finance, one-third was either inaccurate or incorrect.

For the topic of taxes, two-thirds were inaccurate or incorrect!

For the topic of investing, whilst no answers were incorrect, almost half were inaccurate.

These results simply aren’t good enough.

For many tech products, launching something that needs refinement is fine. It’s common for firms to launch a new product and then improve it over time. The video games industry pretty much does this as a rule now.

A tool that can be used to find out finance-related information, though, shouldn’t follow this approach.

The College Investor has said, “We strongly believe that Google should turn off these AI Overviews on finance related topics, especially tax and investment related queries where the outcome can be especially costly for users.”

I agree.

The use of AI-driven search tools is only going to increase. They will improve with time, but for topics such as finance (and health), it’s going to need careful management and gatekeeping.

As things stand, the gatekeeper is looking elsewhere.

What should the industry do?

I’m unsure if there is any precedent for regulators stepping in on the subject of online search.

My guess would be not, because until now, online search has revolved around the concept of linking a searcher to a destination. The search engine acts as the bridge.

Now though, Google is acting more like the destination itself.

For a long time, it has provided information on the weather, movie times, and answers to fact-based questions.

Now, with AI Overviews, it’s moving into far more complex areas, attempting to provide the one-and-done answer to many types of searches.

With the correct type of search, it is theoretically possible to get Google to start providing you with pseudo-financial advice.

To provide financial advice, you must be regulated.

Right now, I think Google should work with regulators to improve its search product in light of the launch of AI Overviews.

Another solution could be to source its ‘protected’ topics from proven trusted sources (ie. regulated financial firms).

In theory, if Google developed a knowledge base trained only on the information provided by regulated financial professionals, it could provide far more reliable search results.

It should also correctly reference the sources of information. It simply wouldn’t be right if the source of the expertise wasn’t correctly acknowledged.

I must add, Google hasn’t directly responded to the findings of The College Investor’s study, so until then, we can only speculate around what it’s doing to improve things.