Creating successful financial products requires a deep understanding of user needs. Gathering actionable feedback is essential for addressing pain points, building trust with users, and ensuring compliance with industry standards.

Here's a practical guide to obtaining valuable insights for improving financial tools and services.

Research Methods

Help Desk Logs

Customer support logs are a goldmine for identifying recurring pain points and user frustrations. Analysing support tickets can reveal issues such as authentication problems, transaction failures, or feature requests. For instance, if many users complain about complex login procedures, simplifying multi-factor authentication (MFA) can increase engagement.

- Approach - Categorise and analyse help desk tickets to identify frequent issues, segmenting by staff and customers. Regularly review trends and prioritise fixing the most impactful problems, such as critical transaction errors, blockers during onboarding or common feature requests.

-

Tools to use - Zendesk, Intercom, and other CRMs can help organise and track support tickets, while data visualisation tools like Power BI allow you to analyse trends.

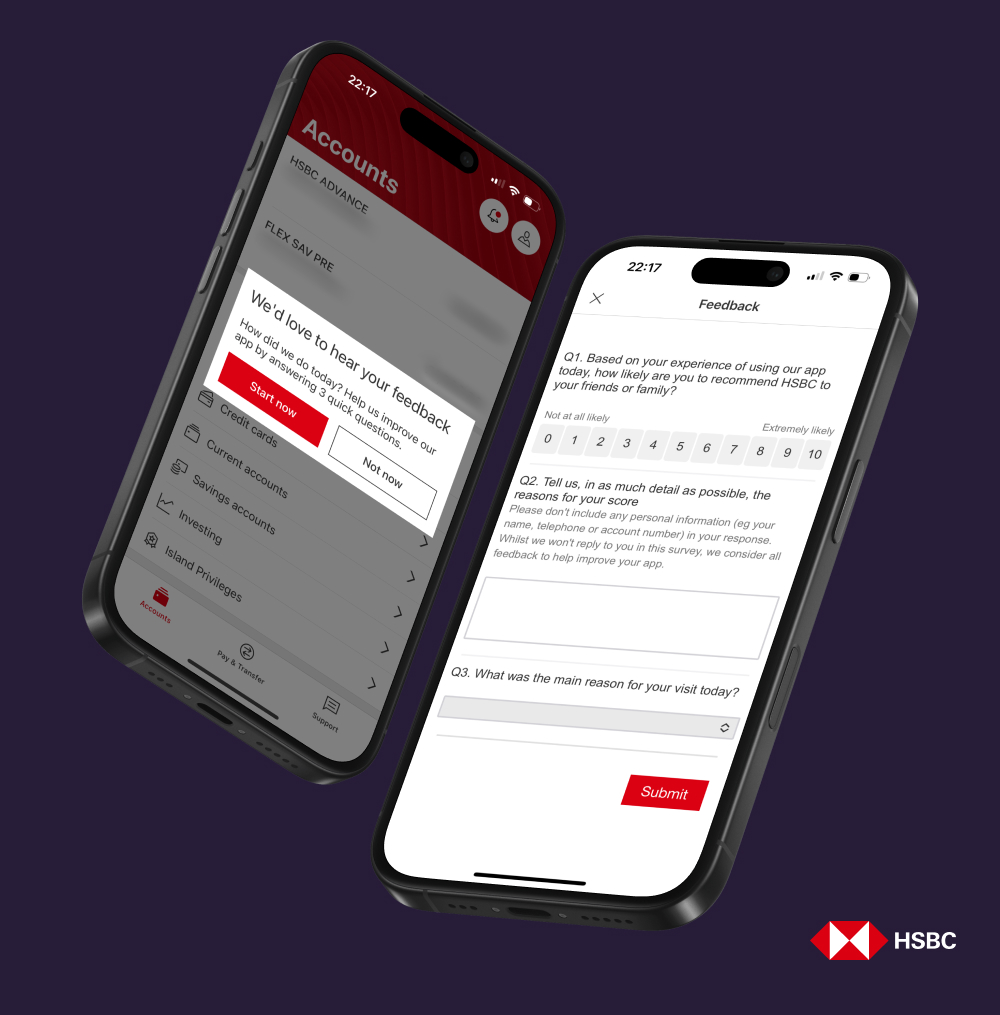

Surveys

Surveys are a scalable way to gather both qualitative and quantitative feedback. For instance, asking users about their trust in your platform or which features they find useful can reveal insights that guide product improvements. Banks often use surveys to explore user concerns, including security issues and overall app adoption.

- Approach - Design targeted questions about trust, usability, and feature preferences. Distribute surveys via email, in-app prompts, or social media, then analyse responses to identify common concerns and desires.

-

Tools to use - SurveyMonkey and Google Forms are easy-to-use survey tools, while Hotjar can create satisfaction surveys or collect a Net Promoter Score at key moments in the customer journey.

User Analytics

Behavioral data is invaluable for uncovering how users interact with your platform. For example, high drop-off rates during account setup can indicate unclear instructions or overly complex forms. By tracking session duration, feature engagement, and goal completion, you can identify and resolve friction points in the user journey.

- Approach - Establish relevant KPIs, such as session duration, task completion rates, and drop-offs. Use session replay tools to observe navigation and identify bottlenecks.

- Tools to use - Google Analytics and Mixpanel track user behavior, while tools like Hotjar, or Clarity offer heatmaps and session replays for deeper insights.

User Interviews

User interviews provide deep insights into user experiences and expectations, especially around trust and usability. Through interviews, users may reveal frustrations with complex navigation or express desire for additional features, such as automated savings recommendations.

- How to approach - Recruit participants from your user base, focusing on those familiar with your product. Prepare interview scripts that explore key pain points, then record and transcribe the sessions to extract actionable insights.

- Tools to use - Use tools like Teams or Google Meet for virtual interviews, Grain for AI transcriptions, and User Interviews for participant recruitment.

Usability Testing

Usability testing identifies friction points in navigation and user flows, such as confusion during transactions account setup. If users struggle to find key features, a redesign of the navigation menu might be necessary.

- Approach - Select representative users for testing and assign them with realistic tasks to complete. Observe their interactions with your platform and ask follow-up questions to identify areas for improvement.

- Tools to use - Platforms like Maze or UserTesting allow you to conduct remote usability tests, while Figma can help create clickable prototypes before full implementation.

Supercharging Studies with AI

AI can accelerate the research process by refining questions and analysing results more efficiently. However, it should complement- not replace - real user testing and feedback, which remain crucial for truly understanding user needs.

- Refining questions: Use AI to draft clearer and unbiased survey or interview questions, like asking ChatGPT to rephrase queries to eliminate leading language.

- Transcribing interviews: Use AI-powered tools, such as Otter.ai, Grain, Gemini (for Google Meet), or Plaud for in-person interviews.

- Sentiment analysis: Tools like MonkeyLearn or IBM Watson categorise user feedback into actionable themes, such as security concerns or navigation issues.

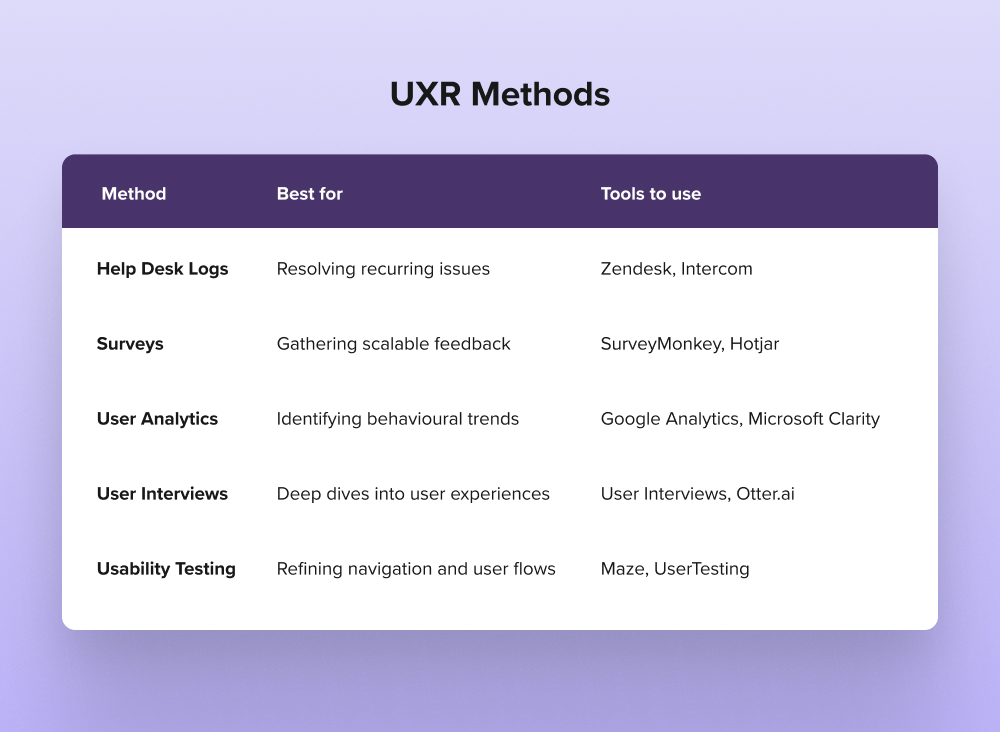

Matching Methods to Challenges

Before diving into research, clarify your goals. Identify which UXR methods align with your objectives and the tools that can assist using the table below.

Decision-Making Framework

When selecting research methods, it’s easy to feel overwhelmed. Not all problems require in-depth user research - sometimes it’s fine to dive straight into making measurable changes, especially if the risk of getting it wrong is low and the problem is simple.

However, for complex issues where the stakes are high, advanced UX research methods become crucial. These approaches allow you to understand and solve intricate challenges, ensuring that you not only address surface-level issues but also meet underlying user needs.

Here’s a handy framework for selecting the right UXR method:

Conclusion

By integrating these user research techniques and leveraging AI as a research assistant, you can create financial products that are more intuitive, trustworthy, and user-friendly.

Balancing the right mix of methods with problem complexity ensures that you address user pain points effectively. Ultimately, the goal is to create experiences that delight users, build trust, and set your financial tools apart in an increasingly competitive landscape.